Is TAPM Undervaluded?

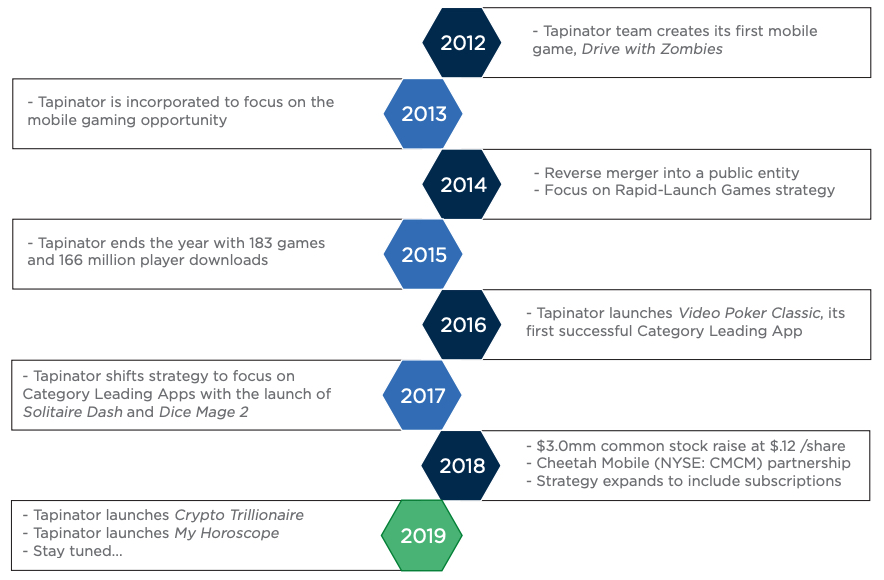

Tapinator is focused on developing a portfolio of category-leading mobile apps that have lucrative and long-term monetization potential. Tapinator is expected to realize elevated earnings potential as they’ve recently changed their strategy in response to the maturation of casual mobile games in recent years. 450 Million Mobile Downloads & Growing! Their initial business strategy that focused on rapidly-launched, hypercasual games helped Tapinator gain traction in the mobile gaming industry and record over 450 million consumer downloads through 2018. Now, a new strategy has repositioned the company to earn much higher revenues in the future.

After 18 months of testing, Tapinator's management has recently unveiled its current, more powerful strategy focused on category leading apps in evergreen categories. These freemium apps, often with subscription based monetization, are being developed by Tapinator to create a portfolio of recurring and stackable revenue streams. In fact, Tapinator’s social casino game, Video Poker Classic, has become the leader within the lucrative and evergreen video poker category across all the leading US mobile platforms.

To this end, Tapinator is focused on developing mobile apps that are expected to accommodate and survive the dynamic nature of the mobile smartphone market. The company has proven itself adept at analyzing global user behavior to determine market opportunities for mobile applications and games that support Tapinator’s strategy of developing the #1 or #2 leading product in a particular category. In addition to achieving this position within the video poker category, Tapinator currently has properties that can potentially achieve #1 or #2 within the lucrative categories of solitaire, astrology and idle games.